Maricopa County Az Property Tax Bill . in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. Over 95 percent of all maricopa. This includes the county, city school districts, special taxing. the maricopa county treasurer sends out the property tax bills for local jurisdictions. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. Rule a is the “standard” calculation for lpv. Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or.

from api.mcassessor.maricopa.gov

in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. the maricopa county treasurer sends out the property tax bills for local jurisdictions. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. Don't know your parcel #? Rule a is the “standard” calculation for lpv. This includes the county, city school districts, special taxing. Over 95 percent of all maricopa.

How Do I Pay My Taxes Maricopa County Assessor's Office

Maricopa County Az Property Tax Bill Don't know your parcel #? Over 95 percent of all maricopa. the maricopa county treasurer sends out the property tax bills for local jurisdictions. Rule a is the “standard” calculation for lpv. This includes the county, city school districts, special taxing. Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b.

From www.yourvalley.net

Maricopa County to pay 1.6M after property tax lawsuit Daily Independent Maricopa County Az Property Tax Bill the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. Rule a is the “standard” calculation for lpv. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. According to the. Maricopa County Az Property Tax Bill.

From anabalqangelika.pages.dev

Maricopa County Property Tax Rate 2024 Dorri Germana Maricopa County Az Property Tax Bill form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. Over 95 percent of all maricopa. in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. Rule a is the “standard” calculation for lpv.. Maricopa County Az Property Tax Bill.

From www.countyforms.com

Maricopa County Personal Property Tax Form Maricopa County Az Property Tax Bill the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. This includes the county, city school districts, special taxing. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. Over 95 percent of all maricopa. the maricopa county treasurer. Maricopa County Az Property Tax Bill.

From www.docdroid.net

maricopacountypropertytaxbillsearch.pdf DocDroid Maricopa County Az Property Tax Bill This includes the county, city school districts, special taxing. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. the maricopa county treasurer sends out the property tax bills for local jurisdictions. in arizona, a property's lpv (taxable value). Maricopa County Az Property Tax Bill.

From sftreasurer.org

Understanding Property Tax Treasurer & Tax Collector Maricopa County Az Property Tax Bill Don't know your parcel #? in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. Rule a is the “standard” calculation for lpv. Over. Maricopa County Az Property Tax Bill.

From fity.club

Property Tax Bill Maricopa County Az Property Tax Bill the maricopa county treasurer sends out the property tax bills for local jurisdictions. Rule a is the “standard” calculation for lpv. This includes the county, city school districts, special taxing. Over 95 percent of all maricopa. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. in arizona,. Maricopa County Az Property Tax Bill.

From www.exemptform.com

Arizona Property Tax Exemption Form Maricopa County Az Property Tax Bill This includes the county, city school districts, special taxing. Rule a is the “standard” calculation for lpv. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. According to the maricopa county assessor’s. Maricopa County Az Property Tax Bill.

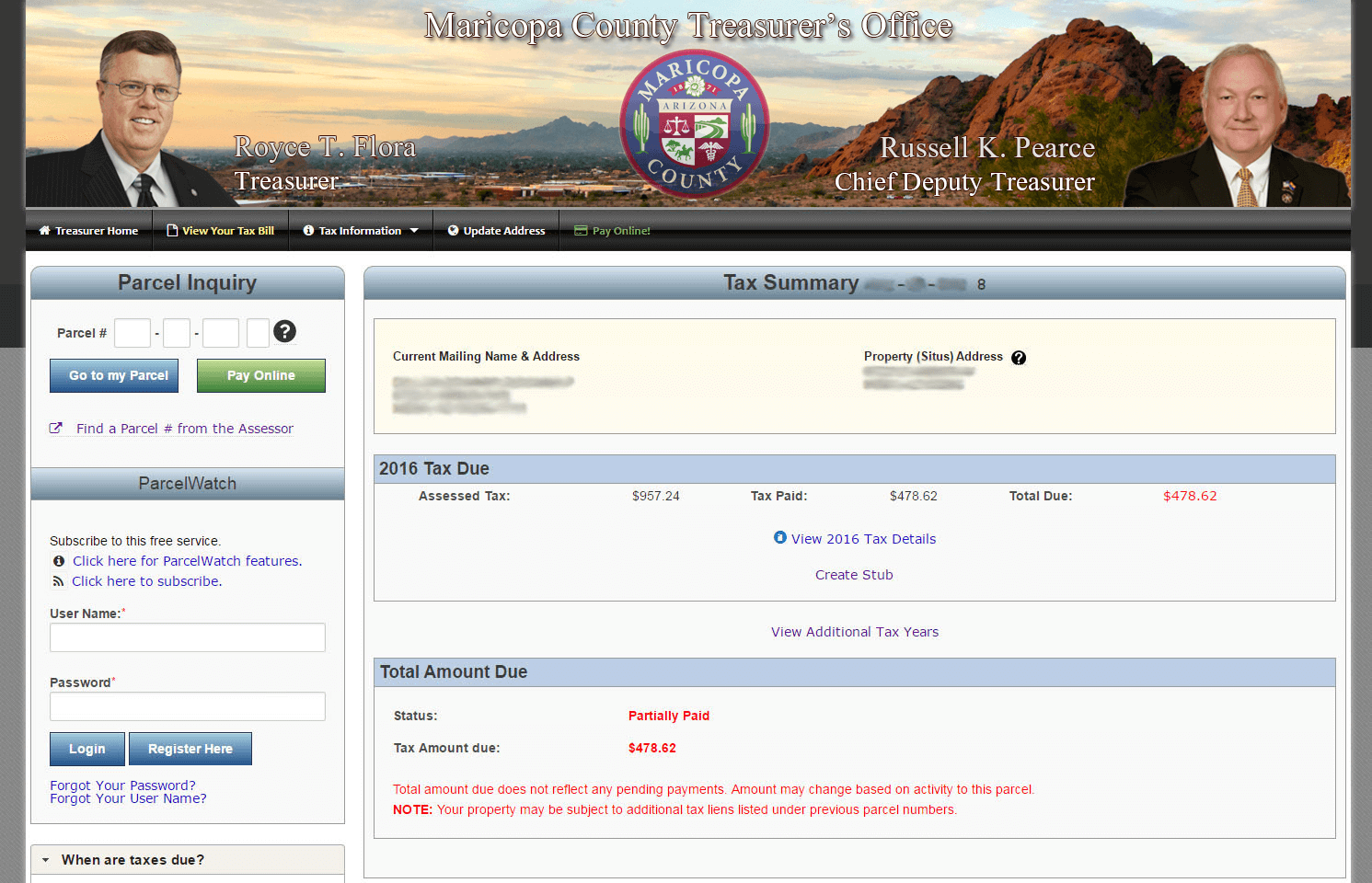

From treasurer.maricopa.gov

Tax Bill Maricopa County Az Property Tax Bill Over 95 percent of all maricopa. the maricopa county treasurer sends out the property tax bills for local jurisdictions. Rule a is the “standard” calculation for lpv. This includes the county, city school districts, special taxing. Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county,. Maricopa County Az Property Tax Bill.

From fity.club

Property Tax Bill Maricopa County Az Property Tax Bill This includes the county, city school districts, special taxing. the maricopa county treasurer sends out the property tax bills for local jurisdictions. Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. According to the maricopa county assessor’s office, this is the physical location. Maricopa County Az Property Tax Bill.

From fity.club

Property Tax Bill Maricopa County Az Property Tax Bill Rule a is the “standard” calculation for lpv. in arizona, a property's lpv (taxable value) is calculated using either rule a or rule b. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. This includes the county, city school districts, special taxing. Don't know your parcel #? Web. Maricopa County Az Property Tax Bill.

From ktar.com

Maricopa County budget plan cuts property tax rate, trims spending Maricopa County Az Property Tax Bill the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. This includes the county, city school districts, special taxing. form 140ptc is used by qualified individuals to claim a. Maricopa County Az Property Tax Bill.

From www.alachuacollector.com

Alachua County Tax Collector Maricopa County Az Property Tax Bill This includes the county, city school districts, special taxing. Don't know your parcel #? Rule a is the “standard” calculation for lpv. the maricopa county treasurer sends out the property tax bills for local jurisdictions. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. form 140ptc is. Maricopa County Az Property Tax Bill.

From fity.club

Property Tax Bill Maricopa County Az Property Tax Bill Over 95 percent of all maricopa. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. This includes the county, city school districts, special taxing. the maricopa county treasurer sends out the property tax bills for local jurisdictions. According to the maricopa county assessor’s office, this is the physical. Maricopa County Az Property Tax Bill.

From www.azcentral.com

Average Maricopa County propertytax bill rises 5.4 Maricopa County Az Property Tax Bill form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. According to the maricopa county assessor’s office, this is the physical. Maricopa County Az Property Tax Bill.

From fity.club

Property Tax Bill Maricopa County Az Property Tax Bill Rule a is the “standard” calculation for lpv. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. This includes the county, city school districts, special taxing. form 140ptc. Maricopa County Az Property Tax Bill.

From activerain.com

Property Tax Rate Changes in Maricopa County (Greater Phoenix, Arizona) Maricopa County Az Property Tax Bill Rule a is the “standard” calculation for lpv. This includes the county, city school districts, special taxing. the maricopa county treasurer sends out the property tax bills for local jurisdictions. Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. form 140ptc is. Maricopa County Az Property Tax Bill.

From www.azcentral.com

Maricopa County property tax bills are out Maricopa County Az Property Tax Bill Don't know your parcel #? the maricopa county treasurer sends out the property tax bills for local jurisdictions. This includes the county, city school districts, special taxing. According to the maricopa county assessor’s office, this is the physical location of the property being represented by this bill. in arizona, a property's lpv (taxable value) is calculated using either. Maricopa County Az Property Tax Bill.

From www.vrogue.co

How To Read Your Property Tax Bill Property Walls vrogue.co Maricopa County Az Property Tax Bill Over 95 percent of all maricopa. the maricopa county treasurer sends out the property tax bills for local jurisdictions, this includes the county, cities school. This includes the county, city school districts, special taxing. Don't know your parcel #? Rule a is the “standard” calculation for lpv. in arizona, a property's lpv (taxable value) is calculated using either. Maricopa County Az Property Tax Bill.